What makes a CMBS loan and why is it unique? In a nutshell, a CMBS (Commercial Mortgage-Backed Security) loan is a type of commercial real estate financing that has been "securitized". But what exactly does that mean? Here's everything you need to know before closing your first CMBS loan.

The History of Securitization

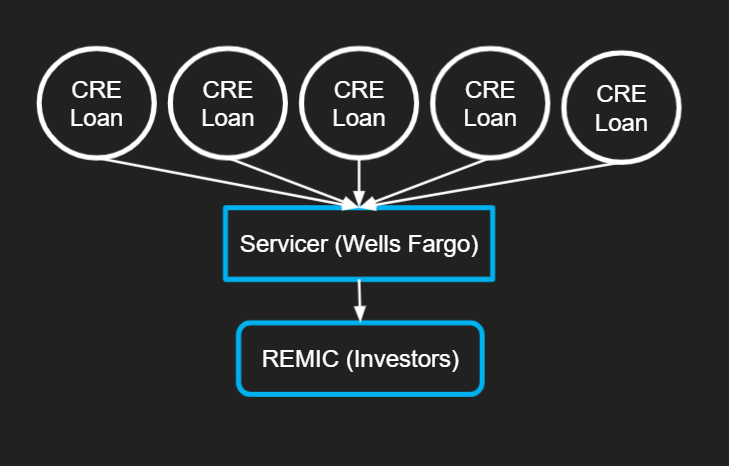

Securitization is a process in which a loan is pooled into a group with other loans.

In the 1980s and early 1990s, real estate lending was done through banks and insurance companies (typical balance sheet stuff).

However, overinvestment into the commercial real estate industry led to a deterioration of assets and a credit crunch in the lending industry. Ethan Penner used this as an opportunity to help inject Wall Street money into CRE markets and provide some relative risk analysis.

Penner pioneered the first CMBS loan with nine loans against properties owned by different sponsors.

CMBS and Securitization

With a typical mortgage in commercial real estate, the lender gets paid back over time. But CMBS introduces a different process.

After initial funding by the financial institution, the CMBS loan is securitized using the properties associated with the loan (typically apartments, offices, and warehouses) as collateral.

It is sold and packaged with hundreds or thousands of other commercial mortgage loans into a trust called Real Estate Mortgage Investment Conduit (REMIC). The loan is then turned into bonds and sold on the secondary mortgage market to bond investors.

Once the bond is sold, the lender that funded the loan is repaid — minus a small percentage for risk retention. The lender then has the funds to deploy additional mortgages.

To pay off a CMBS loan, borrowers must structure a Defeasance portfolio.

Exiting Via Defeasance

Since CMBS loans behave like bonds, you cannot prepay early; instead, you must exit via a defeasance.

Defeasance is the process of replacing the property collateral with a portfolio of Treasury securities that match the debt service payment of the loan — you must substitute the collateral. Its price is based on a required yield calculated by discounting the remaining coupon payments over the life of the bond. This can be completed in as little as 2 weeks, but most take 30+ days.

To calculate your defeasance penalty, you can simulate a stream of Treasury bonds across the remaining loan payments or use the LoanBoss calculator.

In the Loan Docs

From an abstract standpoint, CMBS loan docs are fairly simple — mostly because they are very similar!

CMBS loans are usually very structured; they have similar characteristics from loan to loan. The majority of the time, you'll see fixed rates with a defeasance payment and it makes it easier to predict what other content to expect.

The securitization of CMBS loans helps provide consistency across the board. Because lenders don't want to bundle and sell hundreds of loans that could potentially have drastically different outcomes, they group together similar loans to be sold together.

With that being said, they aren't as easy to abstract as Agency loans. Each CMBS loan typically takes around 2 hours to abstract while Agency loans (such as Freddie or Fannie) take about 30 minutes.

To learn more about Agency loans, click here!

This is partly because they have a few more documents attached, but mostly because they are more complex. CMBS loans are more consistent, but with provisions such as Cash Management and sometimes Leasing covenants and requirements, they have more information and more detailed financial covenants that aren't as critical when abstracting for Agency loans.

Thinking of abstracting your loans? Here are some Questions You Should Be Asking. Or you can download our free abstract template!

Conclusion

CMBS loans are unique due to securitization and the fact that they behave like bonds — you must exit via defeasance.

For first timers, the unfamiliarity of these traits may be intimidating.

While they have their own advantages and risks, closing your first CMBS loan shouldn't be intimidating. Especially if you ask the right questions.

Knowledge is power.

Download our eBook to learn more about CMBS and Defeasance!

Or email us at theboss@loanboss.com.

Stay in the loop and keep an eye out for more industry insights.