Your portfolio is complex. The answers shouldn't be.

"We’ve found LoanBoss to be an invaluable part of managing our portfolio and adjusting strategies in such a dynamic environment. There are very few vendors that feel like partners, but I can honestly say the LoanBoss team treats our business like their own."

Brock Wright, Partner & Chief Investment Officer, The Connor Group

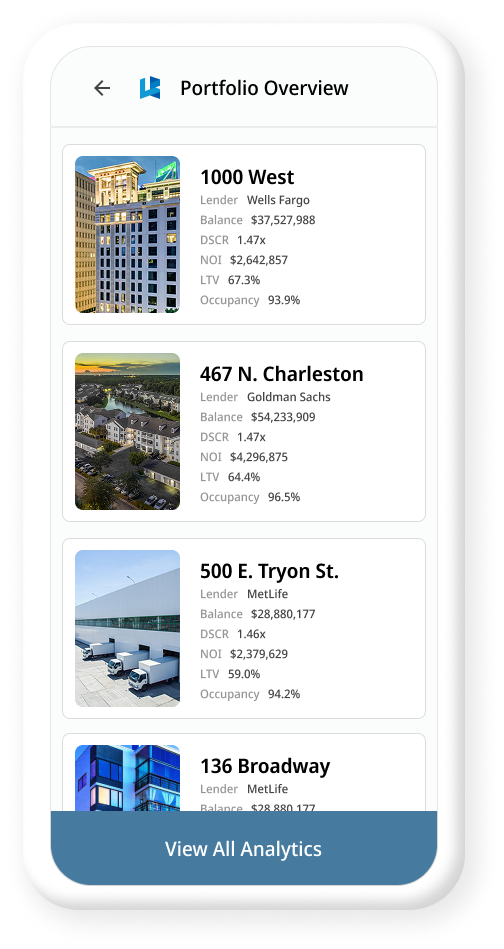

Your entire portfolio. One click away.

Your entire portfolio. One Click away.

Solutions For Every Loan Type

Every loan is unique. Your solutions should be, too.

Solutions For Every Loan Type

Every loan is unique. Your solutions should be, too.

Just because the loans are standardized doesn’t mean the deals are.

- Agency floater amortization - yes, that means we automatically re-amortize the loan each month based on the floating reset for that period. And yes, we tie out precisely with the Agencies.

- Lease requirements.

- Lender approval requirements.

- Insurance requirements/deductibles.

- Real time defeasance and yield maintenance calculations, with the ability to project prepays in the future.

- All prepay conventions automatically reflected in each loan, including the rate lookback.

- Escrows/Repair tracking.

- Hedge requirements with live MtM and replacement cap costs.

- Supplemental calculators for easy tracking plus annual reminders.

- Repair schedule tracking and notifications.

- Real time, exportable, SREO based on Agency templates.

Some of your most important relationships have some pretty unique terms.

- DSCR/DY testing requirements are fully automated and customizable to each distinct requirement.

- Every index, payment convention, and business day adjustment.

- Each type of amortization, such as mortgage style, straight line, step-up, step-down, fixed payment, interest-only periods, and fully custom schedules. Custom draws/paydowns and accounting overrides easy to handle.

- Escrows/Reserves tracking.

- Lease requirements.

- Lender approval requirements.

- Insurance requirements/deductibles.

- Every prepay you can think of - Lockout, Flat Percentage, Aggregate Interest, Spread Maintenance, Yield Maintenance, Make Whole, Swap Breakage, and Defeasance. We'll even alert you before step-downs and calculate exact prepayment costs for any date.

- Swap pricing with real time rates and precise settlement calculations for easy reconciliation.

- Recourse tracking and even keep tabs on burndown.

Debt fund, mezz, pref equity - some of the most hands-on loans in your portfolio.

- Covenant testing with unique lender adjustments, including the ability to project next year's DSCR/DY.

- Different floating indices, different daycount conventions, different business day adjustments…no problem.

- Extension testing with notice reminders and amortization rate changes during the extension periods.

- Interest expenses projections with stress scenarios.

- Lease requirements.

- Lender approval requirements.

- Insurance requirements/deductibles.

- Hedge requirements with live MtM and replacement cap costs.

- Good news money and forced funding dates.

- Fully customizable cashflows to reflect any draws or paydowns.

- Recourse tracking.

- Critical date reminders so nothing slips through the cracks.

Shouldn’t you know your loans as well as the Servicers that report on them?

- Fully automated DSCR testing

- Live defeasance calculations and market projections.

- Debt valuation.

- Cash management provisions and Servicer rights.

- Centralized data for easy monthly reporting updates.

- Weighted average maturity and rate metrics.

- Lease requirements.

- Lender approval requirements.

- Insurance requirements/deductibles.

Tracking draws is one of life’s little treats, right?

- Conditions for advances and allocations

- Lender approval requirements

- Stabilization/completion requirements and deadlines

- Different floating indices, different daycount conventions, different business day adjustments…no problem.

- Easy to input draws based on the day you actually make the draw.

- Critical date alerts.

- Hedges with live rates and MtMs.

- Recourse and burndown.

- Escrow/Reserves tracking

- Interest forecasting.

Even the easy loans still require upkeep.

- Data centralization for easy, real time reporting.

- DSCR/DY covenant testing with every possible lender adjustment.

- Lease requirements.

- Lender approval requirements.

- Insurance requirements/deductibles.

- Real time prepays based on live rates - Lockout, Flat Percentage, Aggregate Interest, Spread Maintenance, Yield Maintenance, Make Whole, and Defeasance.

- Debt valuation.

- Escrow/Reserves tracking.

- Weighted average maturity and weighted average rate.

Solutions For Every Loan Type

Every loan is unique. Your solutions should be, too.

Solutions For Every Loan Type

Every loan is unique. Your solutions should be, too.

Just because the loans are standardized doesn’t mean the deals are.

- Agency floater amortization - yes, that means we automatically re-amortize the loan each month based on the floating reset for that period. And yes, we tie out precisely with the Agencies.

- Lease requirements.

- Lender approval requirements.

- Insurance requirements/deductibles.

- Real time defeasance and yield maintenance calculations, with the ability to project prepays in the future.

- All prepay conventions automatically reflected in each loan, including the rate lookback.

- Escrows/Repair tracking.

- Hedge requirements with live MtM and replacement cap costs.

- Supplemental calculators for easy tracking plus annual reminders.

- Repair schedule tracking and notifications.

- Real time, exportable, SREO based on Agency templates.

Some of your most important relationships have some pretty unique terms.

- DSCR/DY testing requirements are fully automated and customizable to each distinct requirement.

- Every index, payment convention, and business day adjustment.

- Each type of amortization, such as mortgage style, straight line, step-up, step-down, fixed payment, interest-only periods, and fully custom schedules. Custom draws/paydowns and accounting overrides easy to handle.

- Escrows/Reserves tracking.

- Lease requirements.

- Lender approval requirements.

- Insurance requirements/deductibles.

- Every prepay you can think of - Lockout, Flat Percentage, Aggregate Interest, Spread Maintenance, Yield Maintenance, Make Whole, Swap Breakage, and Defeasance. We'll even alert you before step-downs and calculate exact prepayment costs for any date.

- Swap pricing with real time rates and precise settlement calculations for easy reconciliation.

- Recourse tracking and even keep tabs on burndown.

Debt fund, mezz, pref equity - some of the most hands-on loans in your portfolio.

- Covenant testing with unique lender adjustments, including the ability to project next year's DSCR/DY.

- Different floating indices, different daycount conventions, different business day adjustments…no problem.

- Extension testing with notice reminders and amortization rate changes during the extension periods.

- Interest expenses projections with stress scenarios.

- Lease requirements.

- Lender approval requirements.

- Insurance requirements/deductibles.

- Hedge requirements with live MtM and replacement cap costs.

- Good news money and forced funding dates.

- Fully customizable cashflows to reflect any draws or paydowns.

- Recourse tracking.

- Critical date reminders so nothing slips through the cracks.

Shouldn’t you know your loans as well as the Servicers that report on them?

- Fully automated DSCR testing

- Live defeasance calculations and market projections.

- Debt valuation.

- Cash management provisions and Servicer rights.

- Centralized data for easy monthly reporting updates.

- Weighted average maturity and rate metrics.

- Lease requirements.

- Lender approval requirements.

- Insurance requirements/deductibles.

Tracking draws is one of life’s little treats, right?

- Conditions for advances and allocations

- Lender approval requirements

- Stabilization/completion requirements and deadlines

- Different floating indices, different daycount conventions, different business day adjustments…no problem.

- Easy to input draws based on the day you actually make the draw.

- Critical date alerts.

- Hedges with live rates and MtMs.

- Recourse and burndown.

- Escrow/Reserves tracking

- Interest forecasting.

Even the easy loans still require upkeep.

- Data centralization for easy, real time reporting.

- DSCR/DY covenant testing with every possible lender adjustment.

- Lease requirements.

- Lender approval requirements.

- Insurance requirements/deductibles.

- Real time prepays based on live rates - Lockout, Flat Percentage, Aggregate Interest, Spread Maintenance, Yield Maintenance, Make Whole, and Defeasance.

- Debt valuation.

- Escrow/Reserves tracking.

- Weighted average maturity and weighted average rate.

Excel isn't the problem. Repetition is.

The entire industry is built on Excel, but we all know it has limitations. LoanBoss focuses on automating those repetitive functions. We aren't a competitor to Excel, we're a teammate.

Automate things that should have been automated a long time ago.

We get it. Each lender is different, each loan is unique, adjustments are unique. They can be backward looking or forward looking. "Greater of" statements. Hypothetical amortizations. Market rates. Vacancy comparisons. Tenant inclusion/exclusion. Management fees. Reserves.

We have a framed email hanging in our office from a customer telling us it would be impossible to build.

They were among the first to sign up once we did.

Our in-house team of loan experts abstracts every loan to your exact specifications. Each abstract also undergoes two separate rounds of QA. Any solution that doesn't provide this level of detail isn't really a solution.

Your property accounting systems are the central nervous system of your organization. We integrate with them so you don't have any manual updating. They provide the source of truth financial data, we run the complex math. Automated.

LoanBoss is very easy to use, and the ability to run scenarios at the touch of a button has become an invaluable component in our hold/sell analysis at investment committees.

Tom Briney | President, Origin Investments

Complete portfolio visibility without the manual updates.

Get portfolio-wide surveillance that stays current on its own.

LoanBoss unifies loan abstracts, accounting feeds, and live rates to automatically refresh DSCR, balances, rates, MtMs, and cashflows so you spot risks early, and share one source of truth.

Spend time deciding, not updating.

Complete portfolio visibility without the manual updates.

Get portfolio-wide surveillance that stays current on its own.

LoanBoss unifies loan abstracts, accounting feeds, and live rates to automatically refresh DSCR, balances, rates, MtMs, and cashflows so you spot risks early, and share one source of truth.

Spend time deciding, not updating.

Scale your portfolio - not the spreadsheets.

Manual tracking breaks as you grow.

Each new asset adds another spreadsheet, more docs, more formulas, and a higher risk of error. LoanBoss replaces that fragile system with a single, scalable platform. Onboard new loans with a simple, standardized process, and watch as all your reports, covenants, and dashboards, update instantly.

Your foundation is built for growth - not just for getting by.

Scale your portfolio - not the spreadsheets.

Manual tracking breaks as you grow.

Each new asset adds another spreadsheet, more docs, more formulas, and a higher risk of error. LoanBoss replaces that fragile system with a single, scalable platform. Onboard new loans with a simple, standardized process, and watch as all your reports, covenants, and dashboards, update instantly.

Go from 10 loans to 100, knowing your foundation is built for growth - not just for getting by.

Unlock Your Portfolio With More

Unlock Your Portfolio With More

You're three easy steps from streamlined, automated debt management.

Send your loan documents.

Our team abstracts every key term, date, and covenant. You do zero data entry - focus on your day job.

Share your reports.

We take the spreadsheets you already use and build them in LoanBoss, so they're always live and 100% accurate. And your boss gets to keep using the reports they're comfortable with.

Link your property data.

We connect to your accounting software so your portfolio data is always current.

You're three easy steps from streamlined, automated debt management.

Send your loan documents.

Our team abstracts every key term, date, and covenant. You do zero data entry - focus on your day job.

Share your reports.

We take the spreadsheets you already use and build them in LoanBoss, so they're always live and 100% accurate. And your boss gets to keep using the reports they're comfortable with.

Link your property data.

We connect to your accounting software so your portfolio data is always current.

But Wait...There's More!

Loans Managed

Loans Abstracted

Daily Calculations

.png?width=120&name=Full%20Logo%20(1).png)