EVERY LOAN IS UNIQUE

Your solution should be, too

The most comprehensive debt software in the world

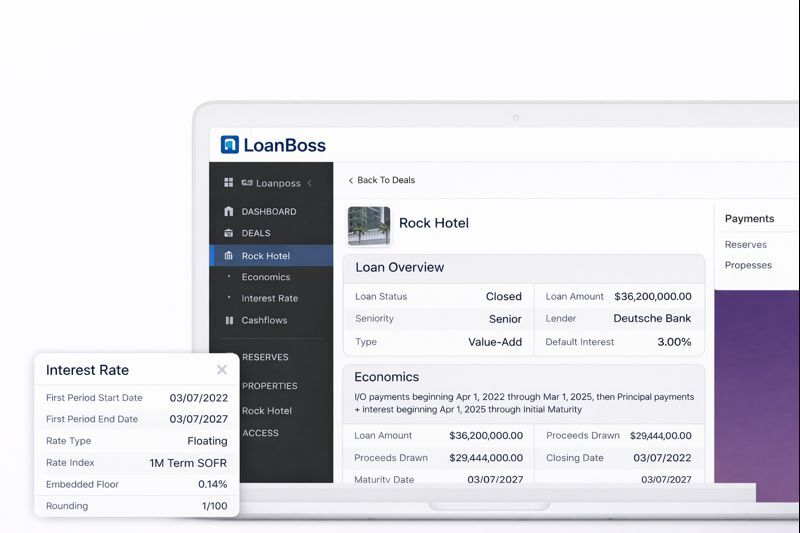

All CRE loan types - Agency, bank, CMBS, agency, construction, bridge, lines of credit, subordinate debt, syndicated and portfolio loans.

More importantly, we handle the complex variations that break other platforms. If it's in your loan docs, it's in our system.

AGENCY

Just because the loans are standardized doesn’t mean the deals are.

- All prepay conventions automatically reflected in each loan, including the rate lookback.

- Agency floater amortization - yes, that means we automatically re-amortize the loan each month based on the floating reset for that period. And yes, we tie out precisely with the Agencies.

- Escrows/Reserve tracking.

- Hedge requirements with live MtM and replacement cap costs.

- Supplemental calculators for easy tracking, plus annual reminders.

- Repair schedule tracking and notifications.

- Real time SREO with Agency conventions.

BALANCE SHEET

Some of your most important relationships have some pretty unique terms.

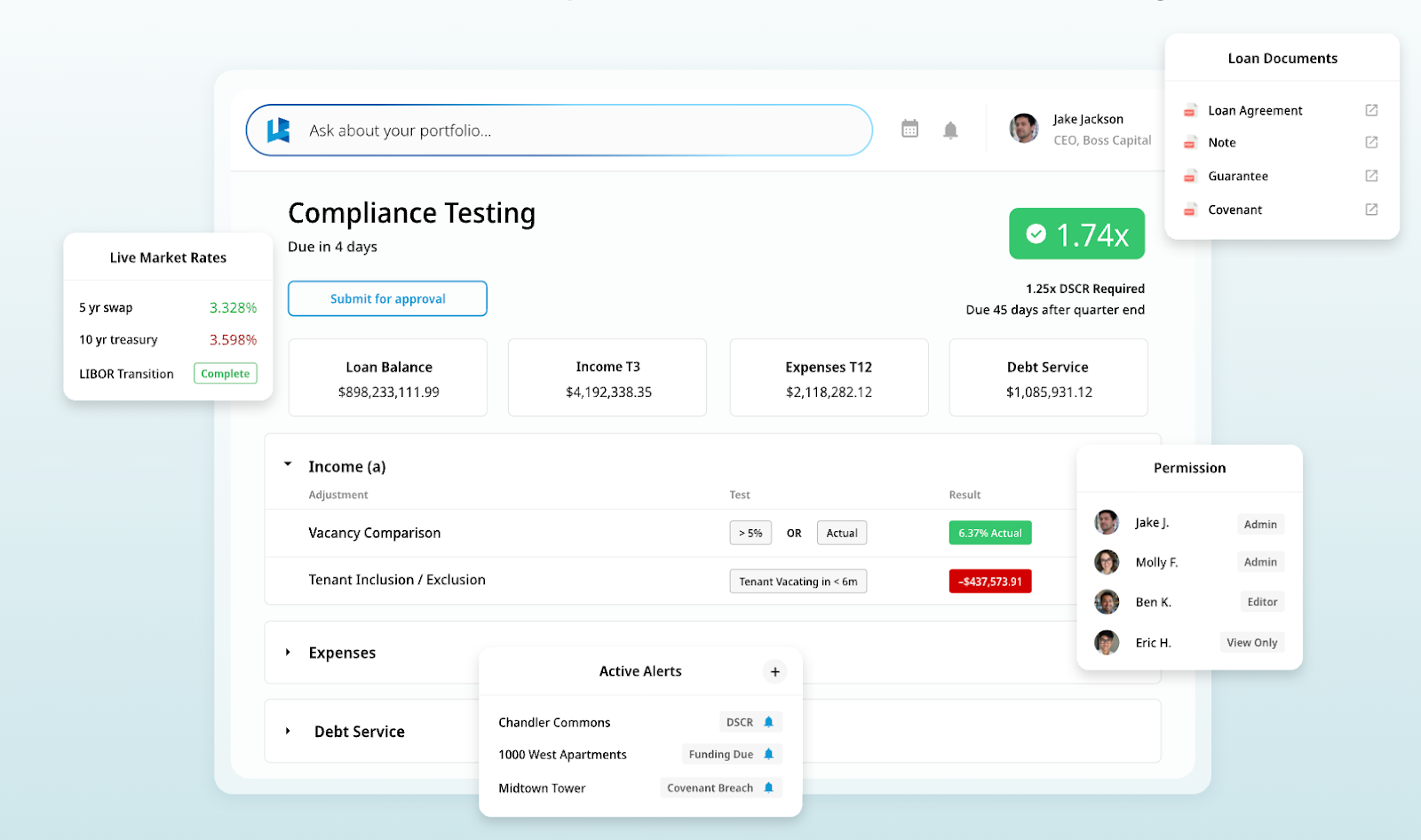

- DSCR/DY testing requirements are fully automated and customizable to each distinct requirement.

- Every index, payment convention, and business day adjustment.

- Each type of amortization, such as mortgage style, straight line, step-up, step-down, fixed payment, interest-only periods, and fully custom schedules. Custom draws/paydowns and accounting overrides easy to handle.

- Escrows/Reserves tracking.

- Every prepay you can think of - Lockout, Flat Percentage, Aggregate Interest, Spread Maintenance, Yield Maintenance, Make Whole, Swap Breakage, and Defeasance. We'll even alert you before step-downs and calculate exact prepayment costs for any date.

- Hedges with real time rates and precise settlement calculations for easy reconciliation.

- Recourse tracking and even keep tabs on burndown.

BRIDGE

Debt fund, mezz, pref equity - some of the most hands-on loans in your portfolio.

- Different floating indices, different daycount conventions, different business day adjustments…no problem.

- Extension testing with notice reminders and amortization rate changes during the extension periods.

- Hedge requirements with live MtM and replacement cap costs.

- Good news money and forced funding dates and the ability to customize draws in cashflows.

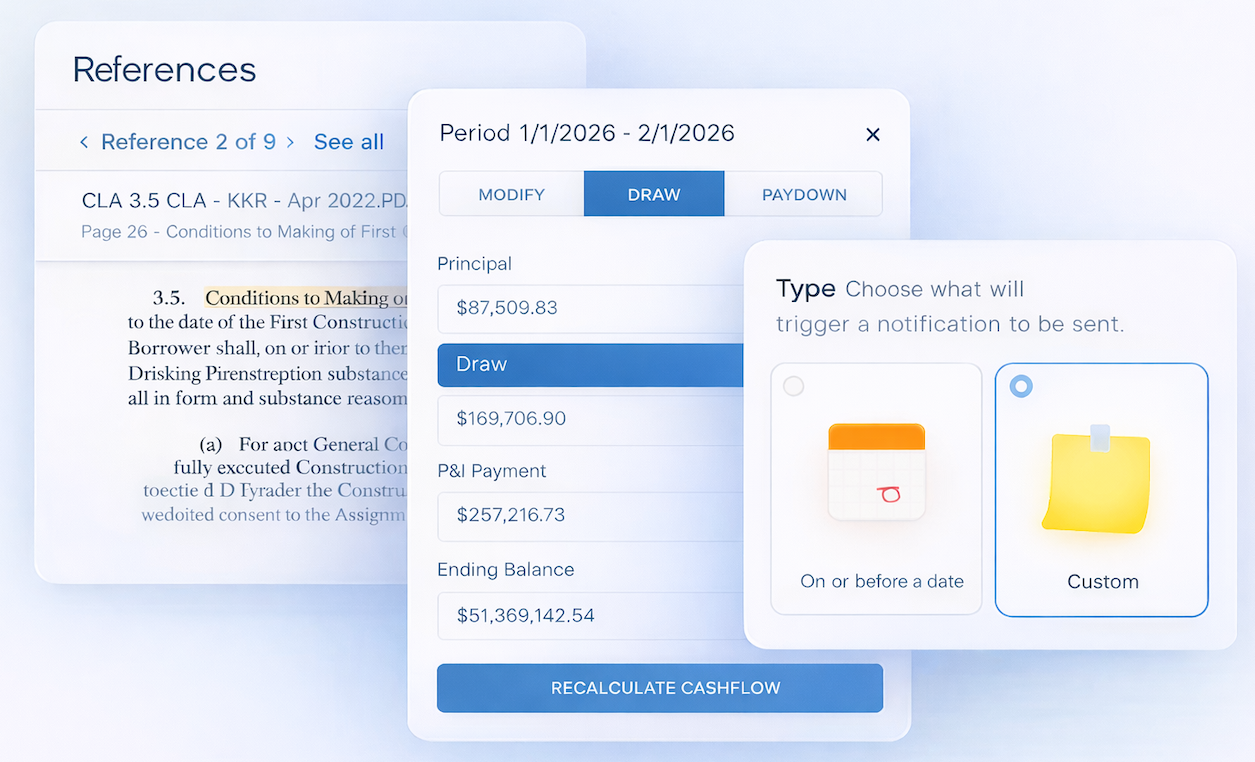

CONSTRUCTION

Tracking draws is one of life’s little treats, right?

Different floating indices, different daycount conventions, different business day adjustments…no problems.

- Easy to input draws based on the day you actually make the draw.

- Critical date alerts.

- Hedges with live rates and MtMs.

- Recourse and burndown.

- Escrow/Reserves tracking.

CMBS

Shouldn’t you know your loans as well as the Servicers that report on them?

- Live defeasance calculations and market projections.

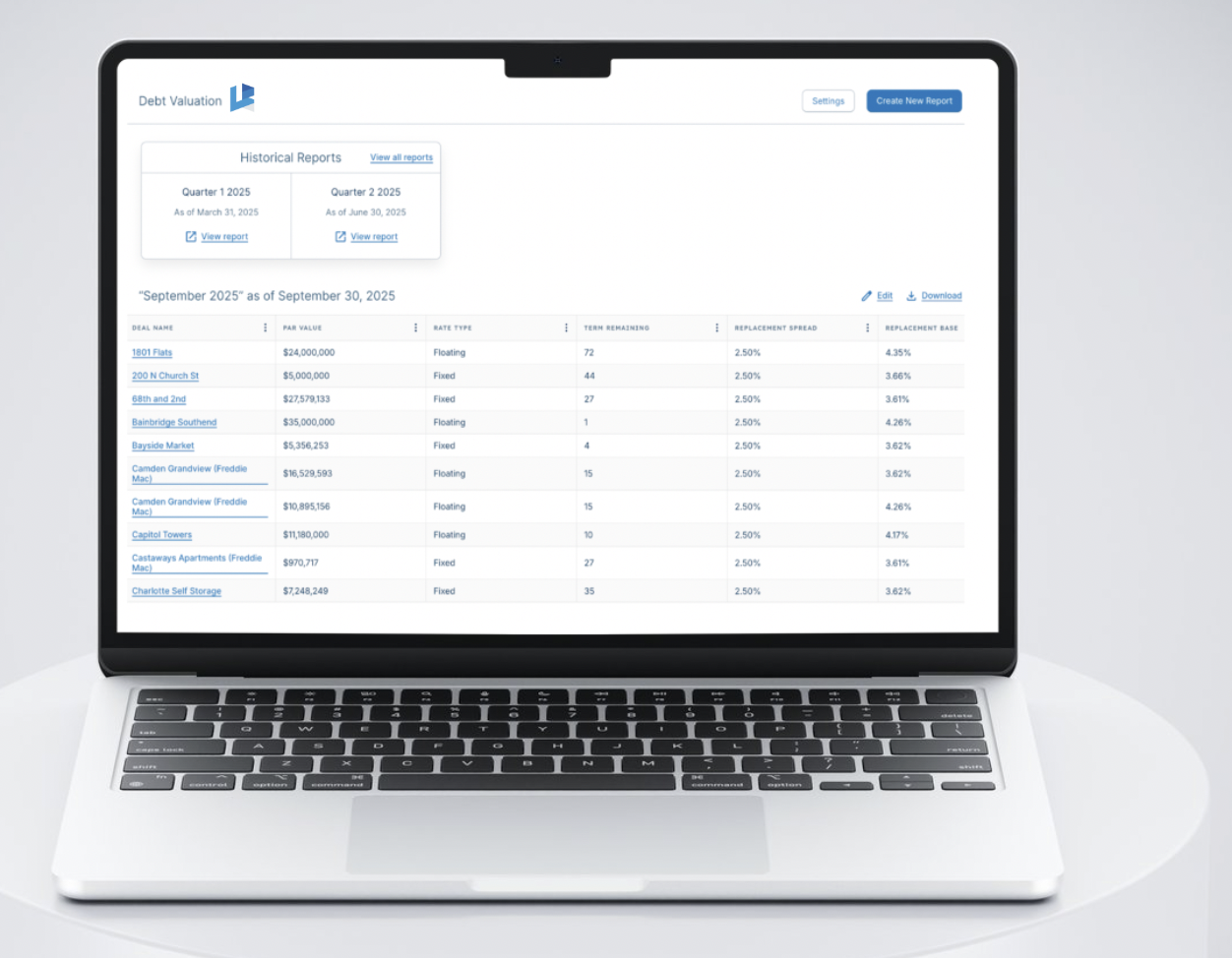

- Debt valuation.

- Centralized data for easy monthly reporting updates.

LIFECO

Even low maintenance loans require some upkeep

- Data centralization for easy, real time reporting.

- DSCR/DY covenant testing with every possible lender adjustment.

- Real time prepays based on live rates - Lockout, Flat Percentage, Aggregate Interest, Spread Maintenance, Yield Maintenance, Make Whole, and Defeasance.

- Debt valuation.

- Escrow/Reserves tracking.

- Weighted average maturity and weighted average rate.

“"We manage a large, complex, 30,000 unit portfolio. LoanBoss has brought accuracy and efficiency to our debt oversight and valuation processes. Having real-time access to key data, cash flows, and lender adjusted metrics - all in one place - gives us the confidence to make faster, more informed decisions across our 170+ loans."

Michael J. Jagodinski, CFO and Principal, MLG Capital

Learn More

Speak with a real estate pro that happens to do tech. Talk to the Boss.

.png?width=1856&height=1038&name=image%20(73).png)