Real estate, particularly commercial and multifamily real estate, has long been regarded as a hedge against inflation. In this blog we look a little closer at the Multifamily sector and when hedging works and when it doesn't.

With the Consumer Price Index (CPI) reaching 7.9% in its most recent reading, and Core PCE – the Fed’s preferred measure of inflation – coming in at 5.2%, many people are looking for ways to hedge against an erosion of wealth through inflation. Traditional inflation hedges like gold and silver come to mind for many investors, with some even looking to naturally deflationary assets like Bitcoin to hedge against inflation.

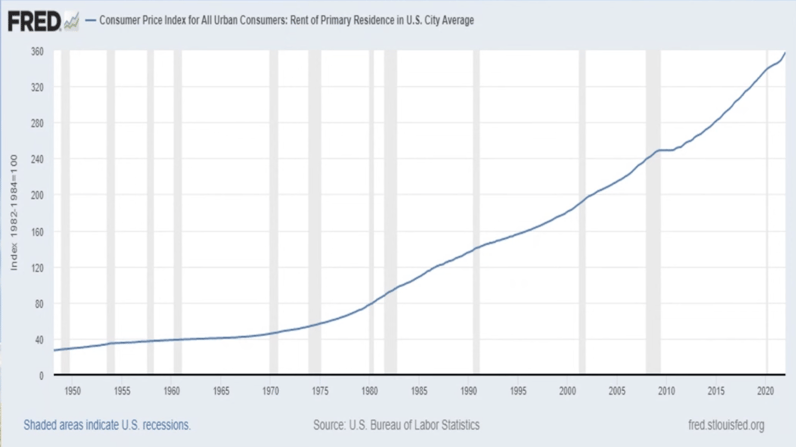

Holding commercial real estate as an investment during a period of high inflation can often be a source of stability when other asset classes wrestle with the effects of rising costs. There’s a strong argument to be made that CRE, and specifically Multifamily, can be one of the best asset types to own when setting up your own inflation hedging strategy. Take a look at the rental rates on this graph. It looks eerily similar to an inflation graph from the same time frame, as if they're moving in lockstep.

"Multifamily is often considered an inflation hedge because, unlike many long-term lease structures for office, retail, and industrial, inflation should be able to be passed through the tenants quickly before expenses can squeeze property incomes."

- Hilary Provinse, Berkadia's EVP, Head of Mortgage Banking

We know you remember the lessons on scarcity from Econ 101, but here's a little refresher.

Physical space is a limited resource that naturally constrains the amount of real estate available. High demand and limited supply is a good recipe for real estate investors. Remember those supply and demand curves? What happens when you keep supply constant but raise demand? The price increases.

Real estate is always scarce (there's only so much space to build on) but in inflationary times, properties are often regarded as a hedge because their value can outpace inflation due to scarcity. And with the current leasing trends that demand is as high as ever.

This can also help reduce volatility in an investment portfolio, stabilizing an otherwise bumpy ride.

But using CRE as an inflation hedge is more nuanced than you may think.

Why? Properties can only hedge against inflation if the cash flow of the property keeps pace with the inflationary rate.

Most commercial leases contain a clause for consistent rental increases, sometimes pegged to inflation. The impact of these clauses is a steady increase in income, partially or fully, offsetting the effects of inflation in some cases.

Rising prices with inflation also includes property rents. During these times you'll often see new leases with more short term contracts to take advantage of those rising rents. And if your lease renewal rate also includes a step up large enough to cover the pace of inflation, then your property value should increase as well, eroding the effects of inflation.

BUT, if price increases of the asset fail to push NOI on par with inflation, then you have failed to hedge.

Of course time will tell, but with rent prices up significantly in 97% of the U.S. compared to this time last year and interest rates on the rise to prohibit housing purchases, properties should have no trouble hitting their numbers. If your rental income rises enough so that your NOI drives property value over the value difference caused by inflation, you have hedged successfully.

Let us know what you think!

Email us at theboss@loanboss.com

Stay in the loop on more CRE trends with our industry insights.