How to Decarbonize Your Real Estate Portfolio

When thinking about global warming and its biggest contributors, you’re likely to jump straight to transportation or industrial activity. While both are huge players in the carbon dioxide emissions game, buildings are too. In fact, buildings are actually the largest contributor of global carbon dioxide emissions!

Commercial real estate, and buildings in general, produce a lot of carbon dioxide. This sector accounts for approximately 40% of all CO2 emissions, directly and indirectly, due to construction and ongoing operations (heating, lighting, and plumbing). Because it has such a large impact on the environment, investors have taken to adopting strategic environmental practices to address the issue with the ESG trend.

It’s easier to quantify the impact of a potential environmental solution because it's more tangible — the tangibility makes it easier to turn strategies into actionable changes.

Even in commercial real estate, "reduce, reuse, recycle" holds true as being some of the best methods to cut back on your carbon footprint. With the EPA estimating that there is 600 million tons of Construction and Demolition debris generated annually in the US, companies turn to the 3 R's (reduce, reuse, recycle) whenever possible!

“When you start talking about sustainability and you explain how a company is more sustainable, using real estate as an example, people can grasp that quickly because they’ve changed the light bulb, they’ve paid a utility bill, they’ve had materials in their building that they like and some that they don’t like and so it’s very tangible, very real for investors.” - Sam Adams, CEO of Vert Asset Management.

Construction and Embodied Carbon

On the construction side, the amount of carbon used to construct the building (extraction of raw materials, production of materials, transport, construction/deconstruction, and disposal of materials) is known as embodied carbon and is roughly equal to its carbon emission for the first couple of decades!

The creation of 3 common building materials — concrete, steel, and aluminum — are responsible for 23% of total global emissions. While these materials can be used in other things, they are primarily used for buildings.

How to cut back.

Instead of constructing new buildings, reuse them! Adaptive reuse is a great way to get creative with the way you can use a building that is already built. Renovate or repurpose existing structures and materials to reduce the amount of new materials needed — this is also a cheaper option!

But building from the ground up can also be more environmentally friendly through thoughtful use and strategic design. Design plays an important role. Optimizing structural design minimizes the amount of carbon-intensive materials used.

Using lower-carbon materials also has a huge impact. For the proposed Assemble Chicago project, low-carbon concrete is going to be used — the concrete is specially treated. A change in methodology causes the concrete to be more expensive but will ultimately also require less material.

Operations and Carbon Emissions

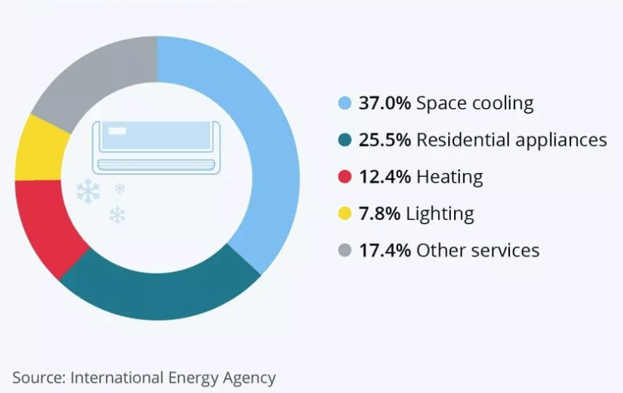

Building operations alone attribute approximately 28% annually to global carbon emissions. This is largely due to the plethora of energy sources needed for everyday operations and maintenance such as lighting, heating/cooling, plumbing, ventilation, etc.

Energy usage for buildings is commonly divided by the following operations:

How to cut back.

Cutting back on operational carbon emissions takes time and effort. But from behavioral changes to equipment changes, there are several ways to address this.

The most straightforward way to decrease energy/water consumption is by decreasing actual usage through behavioral changes. However, there are other practices that can achieve this; it can also be done through building design/layout and upgrades to equipment.

On the design side, buildings can decrease the need for cooling/heating with green roofs, strategic usage of windows, planting trees outside, etc. Buildings can also implement the use of a water bank to harvest rainwater that can be used throughout the building.

On the equipment side, artificial intelligence (AI) technology can be extremely useful in becoming energy-efficient; energy and water efficiency can be improved with programmable thermostats, smart water monitoring technology, etc. Solar panels alone were once thought to be difficult to attain due to their price tag but the price of solar panels has dropped around 80% since 2010 and prices are still dropping. Using (cost effective) technology known today could cut energy consumption by more than 20% within the decade; with continuous research and advancements, energy use could decrease more by 2030.

There are also other alternatives to improve efficiency that are a little more “old-school”. Changes to lighting, plumbing, and heating are simple but effective and can also significantly reduce costs in everyday operations and maintenance; shifting to low-flow plumbing, dimmer switches, LED lights, etc. are just as effective.

However, the limited amount of data available for ESG measurements makes it harder to strategize and this is in part due to the lack of definitive benchmarks. Benchmarks are constantly changing and have evolved to be stricter and more nuanced — which has helped measurability — but there are still key environmental factors missing to find the true impact of the asset.

While there are still challenges associated with sustainability within commercial real estate, it’s clear that investors are taking the ESG movement seriously, especially on the environmental side. As the movement continues to progress, it’ll be interesting to see how they take a more holistic approach on the social and governance side.

Let us know what you think!

Email us at theboss@loanboss.com

Stay in the loop on more CRE trends with our industry insights.